Vocabulary for Mergers and Consolidations

Listed below are some important terms that may be used throughout this guide. Please refer back to this section whenever there is a word or concept that is not defined in the later parts of the guide, because it may be defined here. The Guide to Mergers and Consolidations of Not-for-Profit Corporations (PDF) prepared and circulated by the Charities Bureau of the New York Attorney General’s Office is another great resource for basic information and terms associated with these organizational changes.

- Constituent Corporation:

- Name for a not-for-profit corporation involved in the transaction. One constituent corporation will merge or consolidate with the other constituent corporations.

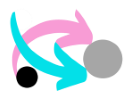

- Merger:

- Organizational change where constituent corporations become a single corporation, and the resulting corporation (referred to as the “surviving corporation”) is one of the merging corporations. This means that the other organizations will cease to exist in favor of one of the corporations involved in the transaction. For example, if not-for-profit A and not-for-profit B merge, and A survives after the transaction, then B merges into A, A is called the “surviving corporation” and B would cease to exist as an independent entity.

- Consolidation:

- Organizational change where constituent corporations become a single corporation, and the resulting corporation is a new corporation, called a consolidated corporation. None of the constituent corporations continue to exist independently and the not-for-profit that results is a newly formed entity. For example, if not-for-profit A and not-for-profit B were to consolidate, a new not-for-profit, C, would emerge and A and B would cease to exist in their independent capacities. A and B would be the constituent corporations and C would be the consolidated corporation.

- Surviving corporation:

- The corporation that remains after one organization is merged into the other. The resultant corporation is termed the surviving corporation. This will be the case only when the transaction takes the form of a merger of two or more not-for-profits.

- Stakeholders:

- All those interested in the outcome of the merger, consolidation, or fiscal sponsorship. This can include members, employees, donors, charitable beneficiaries, and board members.

- Plan of merger:

- Plan drafted and approved by each constituent corporation that outlines the terms and conditions of the merger.

- Plan of consolidation:

- Plan drafted and approved by each constituent corporation that outlines the terms and conditions of the consolidation.

- Non-disclosure agreement:

- Commonly referred to as an “NDA.” The NDA is a contract that prevents the parties to it from divulging confidential information that is entrusted to the party. Those who sign it are bound to keep the information provided confidential.

- Letter of intent:

- Document signed by both parties to a transaction that they will preliminarily commit to doing business with one another and will negotiate and act in good faith.

Important Terminology for Fiscal Sponsorships

- Fiscal Sponsorship:

- The term fiscal sponsorship broadly refers to a number of contractual relationships that allow a person, group, or business to advance charitable or other exempt activities with the benefit of the tax-exempt status of a sponsor organization. For more information please see NYLPI Fiscal Sponsorship Guide (PDF).

- Fiscal Sponsorship Agreement:

- The formal legal document that memorializes the terms of the agreement between the fiscal sponsor and the individual, business, or project to be sponsored.

- Incorporated v. Unincorporated Organizations:

- An incorporated business, or a corporation, is a separate entity from the business owner and can be seen as having its own rights apart from the individuals who work for the organization. Unincorporated businesses are usually sole proprietorships or partnership companies. The main differences between an incorporated and unincorporated business is the way owners shoulder business activities, the way tax status is determined, and the amount of liability placed on business owners. For more information, please see What is the Difference Between Incorporated v. Unincorporated Businesses?

- 501(c)(3) Tax-Exempt Charitable Organizations:

- Section 501(c)(3) is a portion of the U.S. Internal Revenue Code (IRC) and a specific tax category for nonprofit organizations. Organizations that meet Section 501(c)(3) requirements are exempt from federal income tax. While the Internal Revenue Service (IRS) recognizes more than 30 types of nonprofit organizations, an organization that qualifies as a 501(c0(3) is unique because donations are tax-deductible for donors. For more information, please see 501(c)(3) Organizations.

- Preapproved Grant Model:

- This model is the most common method used in fiscal sponsorship agreements where the fiscal sponsor accepts donations for the sponsored project and makes periodic grants to the sponsored project in response to specific funding requests. For more information and requirements of this model please see NYLPI Fiscal Sponsorship Guide (PDF).

- Commingling of Funds:

- Commingling refers broadly to the mixing of funds belonging to one party with funds belonging to another party.

- Dissolution of the Fiscal Sponsorship:

- The process of ending the fiscal sponsorship agreement once the sponsored project comes to an end, or the project has received its own tax-exempt status.